- One click, one loan: simplified access to online financing at your fingertips!

- One click, one loan: simplified access to online financing.

Kredit Konnect

Find the loan that best suits your situation.

Consumer Credit

Find out why Kredit Konnect is the ideal choice for your consumer credit.

Consumer credit is widely regarded as a timely financial solution for many consumers, enabling them to realize their personal projects while maintaining control of their budget. More and more people are choosing to finance a variety of purchases, such as a vehicle or education, using credit, whether by choice or necessity. However, it’s crucial to take into account a number of essential points before committing to this approach, in order to make an informed choice. With this in mind, Kredit Konnect is the ideal, reliable solution to meet your needs.

.

What is consumer credit?

A consumer credit is a loan granted to an individual by a bank or specialized organization, either directly or through a third party (store, merchant site, online comparator, etc.).

The amount of a consumer credit is between €200 and €75,000 and can only be used for private expenses, i.e. not related to your professional activity, not intended for the construction or purchase of a property.

Consumer credit can be used to finance a wide range of projects, including home improvements, a trip abroad, a wedding, the purchase of a car or household appliances. In return, the borrower agrees to repay the loan plus interest in instalments. Consumer credit is governed by the French Consumer Code.

How does consumer credit work?

Consumer credit: how does it work?

Easy to obtain, consumer credit is subject to a number of rules designed to protect the consumer and defined by the French Consumer Code.

Every offer of a credit contract must provide potential borrowers with all the information they need to make an informed decision:

- The nature of the credit,

- Its duration,

- Its annual percentage rate (APR), including charges, in large print,

- Its total cost, including a precise, costed example,

- The number of installments and the amount of each installment.

As a Kredit Konnect borrower, you can take advantage of competitive rates, flexible repayment terms and simplified loan management. What’s more, Kredit Konnect is committed to providing a transparent and clear service, explaining all the terms and conditions of the loan, including any fees and repayment schedules.

3

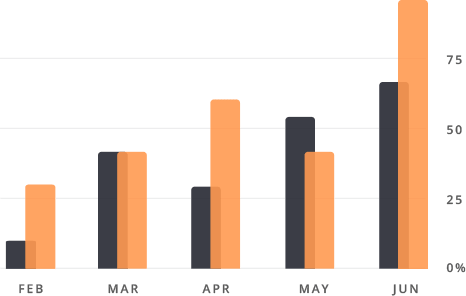

Interest Rate

95

Reliability

100

Speed

Get your loan now!

Get your financing in just a few clicks with our fast, secure online form.

Consumer loans: what are the different types of credit?

Affected credit

Affected credit (affected personal loan) is credit granted for a specific purpose:

- a car ;

- kitchen ;

- of the work ;

- etc.

Affected credit offers the buyer several security advantages:

- if the loan is refused, the purchase is automatically cancelled, except in the case of a change of payment method to cash;

- repayment of the loan only begins once the goods have been delivered or the services rendered. Non-delivery, defective goods or non-performance of services will result in cancellation of the loan contract;

- if the borrower withdraws from the loan within the statutory cooling-off period, the sale is cancelled;

- a possible dispute during the contract may lead to suspension of repayment, and if the sale is cancelled, to termination of the loan.

Unallocated credit

Unrestricted credit is granted to private individuals to finance all kinds of needs, and is a no-obligation consumer credit. The funds are paid into the bank account in a single instalment and repaid monthly, with interest.

This type of loan is easier to obtain, but has a higher interest rate, since the bank or lending institution has no guarantees as to how the money will be used.

Revolving credit

Revolving credit consists of a reserve of money that the borrower can use freely, in whole or in part.

As he repays the sums spent during the term agreed in the contract, the initial reserve is replenished up to the authorized amount, and can be used again.

Features of our Consumer Credit :

Our consumer credit offer is designed to meet the financing needs of our customers. With competitive interest rates, flexible repayment terms and fast approval, our Auto Credit is a practical solution for those looking to finance personal projects or consolidate debt. We work closely with our customers to provide financing tailored to their needs and budget.

- Loan amounts from 2,000 € to 3,000,000 € according to your needs and repayment capacity.

- A repayment term that can range from 6 months to 30 years, depending on the amount borrowed.

- A competitive interest rate of 3% fixed for the entire term of the loan.

- Please note that depending on your loan application, various justified fees may be applied throughout the process.

Kredit Konnect

A wide range of online loan options at Kredit Konnect.

Whether you’re looking to consolidate debt, buy a car or finance a business project, we have flexible loan options to suit your needs. With competitive interest rates, flexible repayment terms and an easy online application process, we’re here to help you find the ideal financing.

Car/Motorcycle credit

Looking to finance the purchase of your next car or motorcycle? At Kredit Konnect, we offer you a quick and easy online car/motorcycle credit solution.

Credit Repurchase

Have you accumulated several loans and are having difficulty repaying them? A credit repurchase is the solution you need to simplify your finances and reduce your monthly payments.

Business loans

Are you a business owner or entrepreneur looking for financing for your professional project? At Kredit Konnect, we offer business loans tailored to your needs.

Why choose Consumer Credit from Kredit Konnect.

- 100% online loans for a fast, streamlined experience

- Simplified management of your reimbursements

- Personalized support from loan application to repayment.

- A competitive interest rate, fixed for the duration of the loan.

- Fixed monthly payments, for easier budget management.

Kredit Konnect

Simple, Fast and Efficient

Online request

Go to our website and fill in our online loan application form.

Analysis

At Kredit Konnect, we take into account your credibility and ability to repay.

Validation

Once your application has been approved, we will draw up a loan contract for you.

Reception

The money is transferred directly to your bank account. Quick and easy.

Apply for your loan online today!

Get the financing you need now with Kredit Konnect.

KREDIT KONNECT

NEWSLETTER

Don’t miss our next updates! Subscribe today!

Copyright © 2019. Made by Kredit Konnect. All rights reserved.